END OF YEAR PRICING! AND CLOSING COSTS PAID UP TO $10,000 on Quick Move in Homes.

![]()

And in Recognition of Breast Cancer Awareness Month:

Gehan Homes Will Donate $250 towards the

Fight Against Breast Cancer For Every Home Sold.

END OF YEAR PRICING! AND CLOSING COSTS PAID UP TO $10,000 on Quick Move in Homes.

![]()

And in Recognition of Breast Cancer Awareness Month:

Gehan Homes Will Donate $250 towards the

Fight Against Breast Cancer For Every Home Sold.

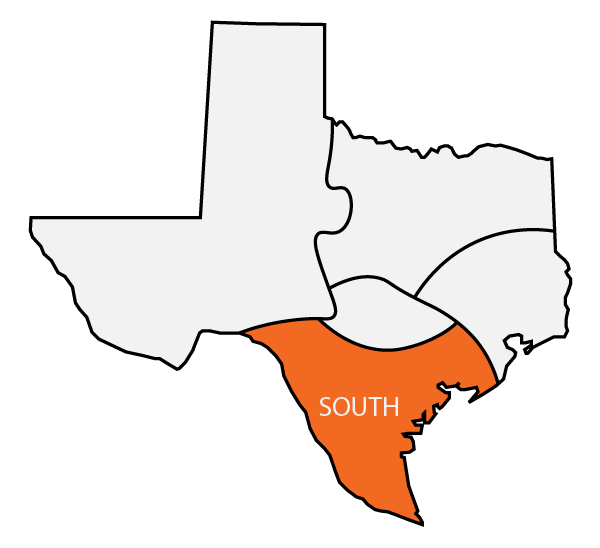

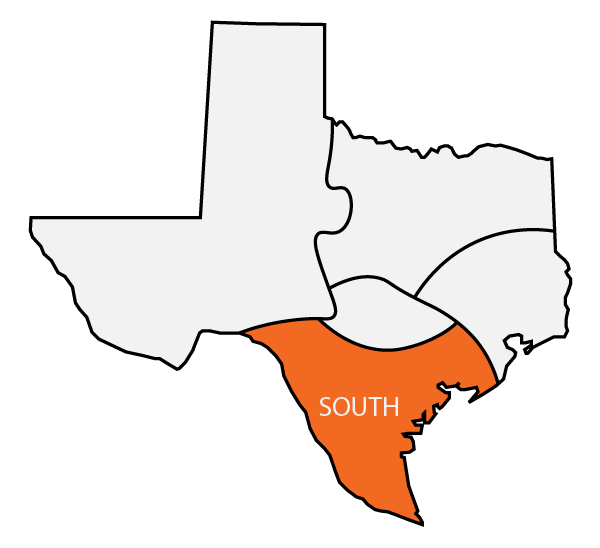

This offer is good in the Sweetwater Subdivision in Southwest Austin.

From the $330,000s

Model Home Now Open!

6116 Llano Stage Trail | Get Directions

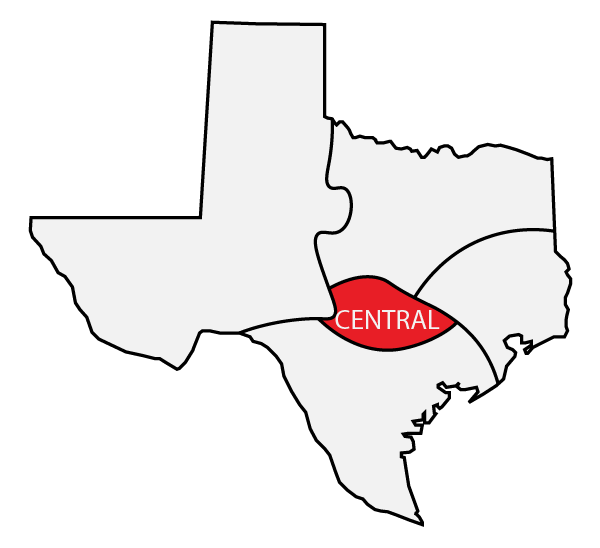

Save thousands of dollars on your New Home Purchase any where in the state of Texas. This Rebate is good at almost every New Home Builder in Texas.

Be sure when visiting any new builder to let the sales councelor be aware that you are working with Austin Homes, Realtors as your Broker

As a License Texas Broker we can help you buy New Homes anywhere in the State of Texas. That means we can help you get a Rebate on your Texas new home purchase. We have 15+ years of real estate expertise and have been a part of over 925+ closings. Every agent can give you a rebate, but can they give you full service along with their rebate?

The first step is to fill out the Buyers Agreement form and then proceed to your new area home builder. Then you register with the builder showing them the agreement and registering my name. The next step is to find the home of your dreams and get it under contract. I can help you with this process either over the phone or in person. Finally we will find out what the builder is paying in commission.

If the builder is paying 3 % you get back 2% CASH BACK

If the builder is paying 4 % you get back 3% CASH BACK

If the builder is paying 5% you get back 4% CASH BACK

If the builder is paying 6% or above you get back 5% CASH BACK

If the builder is paying 7% or above you get back 6% CASH BACK

Jeff Kessler from Rebate on Texas Homes has provided a list of helpful links that will assist you with additional information and resources related to help you make the best decision possible.

These are some great links for your TEXAS REAL ESTATE needs.

Some of the links in this section will take you to Web sites not owned or operated by Jeff. He is not responsible for the condition of these links or the information they provide. If you would like to report an issue with one of these links or the information displayed please contact us and we will investigate the issue.

®National Association of REALTORS (NAR) – The National Association of REALTORS®, The Voice for Real Estate®, is the world’s largest professional association. REALTOR® members of ABoR are also members of NAR.

®Texas Association of REALTORS (TAR) – Headquartered in Austin, TAR is the state-level organization for REALTORS® in Texas.

Texas Real Estate Commission (TREC) – TREC is the state’s regulatory agency for real estate brokers and salespersons. Visit this Web site to download forms or obtain licensee information.

®Women’s Council of REALTORS (WCR) – The WCR is a community of real estate professionals creating business opportunities, developing skills for the future and achieving their individual potential for success.

City of Austin – Review Austin’s official Web site to learn about city developments, planning and zoning.

Texas A&M Real Estate Research Center – The Real Estate Center at Texas A&M University has the answers to your questions on real estate research. Here, you can view home sale statistics from across the state.

Texas Department of Insurance (TDI) – TDI licenses insurance companies, agents, third-party administrators, health maintenance organizations (HMOs), premium finance companies, continuing care retirement communities, and insurance adjusters operating in Texas.

Travis County – The Travis County Tax Assessor Collector collects on behalf of 72 area jurisdictions. Tax rates for those jurisdictions are posted on this site, as they are set by the respective authority.

U.S. Department of Housing and Urban Development (HUD) – Visit the HUD Web site to obtain information on HUD properties and FHA mortgage limits.

Veteran Affairs Loan Guaranty Service – The VA Loan Guaranty Service is the organization within the Veterans Benefits Administration charged with the responsibility of administering the home loan program.

Txcountydata.com – This site is a comprehensive online source of property tax information for all Texas counties. Choicemortgagelenders.info – If you’re a homeowner, you can borrow against the value of your house through either a home equity line of credit (often called a HELOC) or a home equity loan (often called a HEL). Both are essentially a second mortgage.The appeal of both of these types of loans is their interest rates, which are almost always lower than those of credit cards or conventional bank loans because they are secured.

The process of buying a home for the first time can seem a little too difficult. There are a lot of seemingly complicated things happening at any given time in the process, with so many individuals involved. It’s a jungle out there, it seems: all too easy to get lost in figuring out where the dangers are and which way to go next. This article will explain how the process works.

1. Getting Yourself Pre-Approved

Get pre-approved for a home loan. This will involve completing paperwork about your assets and income. Once you are pre-approved, you will know how much you can plan to budget for your home purchase.

2. Getting Your Ideas Together

Start looking. It is good to begin the search already knowing what you want. You can define your ideas systematically, by making a comprehensive list.

3. Identify Home

Bingo! You’ve found it. The right home could be the first one you find or the umpteenth.

4. Offer

Before making an offer, put some serious thought behind it. Find out what price properties in the neighborhood are selling for. Make an equitable offer — too low and you could insult them, or too much and you might end up paying a higher price than you should. Usually, when you make an offer, you will probably need to put up anywhere from 1% to 5% of the asking price as a good faith deposit. Your offer will cover contingencies and terms in addition to price, such as being subject to inspection, necessary repairs, and your preferred date of closing.

5. Agreement

After a little negotiation back and forth, the seller and you will come to an agreement on all the terms of the sale.

6. Review of Title

A title review, in most states, is normally done by a real estate attorney who examines the title, or ownership records of the property, and gives a written opinion as to whether the seller’s title satisfies the requirements of the contract of purchase. In some parts of the U.S. this is done without the services of an attorney but almost without exception there is a requirement for some kind of title search.

7. Home Inspection and Negotiation of Repairs

Never buy property without having it inspected by a third party inspector. A thorough inspection can reveal problems large and small, from mold to a sinking chimney. If the inspection does uncover problems, you will agree on the cost or completion of repairs.

8. Getting an Appraisal

An appraisal offers a professional estimate on the matter of the property’s value. No lender will write a loan for more than the appraised value of the property. For that reason, if the appraised value comes back lower than the sale price, the deal is jeopardized. Actions or workarounds you could possibly take include your making up the difference in cash, the seller agreeing to lower the price to match the appraisal, or requesting a different appraisal.

9. Commitment

You will feel a big sense of relief when the lender completes a review of the documentation and commits your loan.

10. Walk Through Inspection

Your final walk through takes place just prior to closing. During the walk through inspection, you have your opportunity to assure yourself that the property is in the condition in which you agreed to take it — that all repairs that the seller has agreed to make have been made satisfactorily, and that the property has not sustained any damage since you agreed to buy it.

11. Closing

Closing is the transfer of title to the buyer. You will have to hand over the down payment on the property and your share of the closing costs. Before the day of the closing ask your Realtor exactly how much you’ll need to have on hand.

Done! Once you’ve completed those easy steps, you’ll have your home!

Recent Comments